Crypto's a rollercoaster as usual, and we just might be headed for a temporary dip in ICP price. But maybe not! It all depends on if news about ICP's integration with Ethereum makes a big enough splash!

In last week's ICP price prediction, I spoke of steady favorable winds. In retrospect, however, it may have been wiser to hold my tongue, check my enthusiasm, and take a more cautious approach in view of Jonathan Ponciano's recent report in Forbes regarding the precarious situation of the stock market.

Crypto's a rollercoaster as usual, and we just might be headed for a dip.

Beware the Bull Trap

As the disclaimer at the end of each of my ICP price prediction states, "any substantial price gains or losses are difficult to predict." That being said, I think there's a compelling case to be made for listening to the naysayers who are forecasting continued bear market conditions.

Billy Bambrough at Forbes Digital Assets lays out the argument for pessimism. Granted, the cryptocurrency market, particularly Bitcoin and Ethereum, has seen a meteoric rise in value over the last few months, coinciding with the recent stock market rally. However, Morgan Stanley's team of analysts has raised concerns that the recent stock market rally may be a "bull trap," predicting a stock market crash in March that could also bring down the value of Bitcoin and other cryptocurrencies.

Drawing on historical data, the analysts note that bear markets often pause between quarterly earnings seasons before falling further. With uncertainty on the fundamentals of crypto rarely being this high (thanks in large part to SBF), the analysts emphasized that technicals may determine the market's next big move rather than fundamentals. The crypto market has become increasingly linked to the stock market since late 2020, surging to never-before-seen heights before crashing as the Federal Reserve began hiking interest rates and withdrawing liquidity from the system a year ago.

But Don't Despair

Despite these warnings, some reports, like the one by Will Canny at CoinDesk, suggest that Bitcoin and crypto's correlations with equities have continued to decline from the peaks seen last year. For instance, Citi researchers, as Bambrough mentioned in Forbes, have found that the correlations have declined, indicating that Bitcoin and crypto have become increasingly independent of the stock market.

Reasons for Hope in Citi Report

Canny points out that despite recent regulatory action in the U.S. and a dip in stocks, cryptocurrency markets have shown remarkable resilience, according to a recent report by Citi. Analysts led by Alex Saunders emphasized the weakening correlations between cryptocurrencies and equities. While search and on-chain activity have been somewhat erratic, the Citi report observed that stablecoin market caps have stabilized, and the percentage of ether in smart contracts has continued to rise. The report also highlighted that Binance USD outflows increased after the U.S. Securities and Exchange Commission announced its plan to sue Paxos, the issuer of stablecoin Binance USD (BUSD), resulting in a 23% fall in market capitalization. However, these outflows have largely gone into rival stablecoin Tether (USDT), according to the Citi report.

While the total value locked (TVL) activity in ETH terms has not picked up as much as prices, the Citi report found that non-fungible-token (NFT) activity has increased in recent weeks, although transaction levels remain substantially below 2022 averages. Meanwhile, decentralized exchange (DEX) volumes have remained unchanged this month after a steady decline.

Despite the year-to-date rally in digital assets, the Citi report noted that crypto search interest remains low. Nonetheless, the report's observations suggest that the cryptocurrency market has become increasingly mature, with investors becoming more knowledgeable and less likely to panic.

Conclusion: Onward, But Beware the Bull Trap

While it remains to be seen whether Morgan Stanley's prediction of a stock market crash in March will come true, it's clear that the crypto market is still much more intertwined with equity markets than it used to be.

Morgan Stanley stock market bear Michael Wilson has a new warning for Wall Street https://t.co/wCHcYqyqm0

— Bloomberg Markets (@markets) January 23, 2023

It's an exciting time for crypto enthusiasts, and the resilience shown by cryptocurrencies in the face of regulatory pressure and market fluctuations underscores the long-term potential of this innovative sector. But crypto enthusiasts must also tread carefully given the unpredictability of these markets. Overall, one must proceed with caution and an eye for both the technical and fundamentals when investing in crypto.

Weekly ICP Price Prediction

What can we expect for the future of ICP coin price?

In my opinion, the resistance level for ICP has dropped to $6 USD. In the short term, a holding pattern between $5.50 and $6.00 USD seems most likely to me, with some potential for day trading opportunities based on market reactions to ongoing US Federal Reserve interest rate hike discussions. But, I've been wrong before, and if news about ICP's integration with Ethereum makes a big enough splash, we may see some exciting ICP price action sooner rather than later.

#Ethereum & the Internet Computer (#ICP) are soon integrating to fully realize the World Computer vision with new groundbreaking cryptography

— DFINITY (@dfinity) February 28, 2023

Join @JanCamenisch, CTO to learn how to build Web3 apps without Web2 integrations

Let's go fully on-chain🌐https://t.co/5Jv9sUZJVZ pic.twitter.com/PDeWLpdQzo

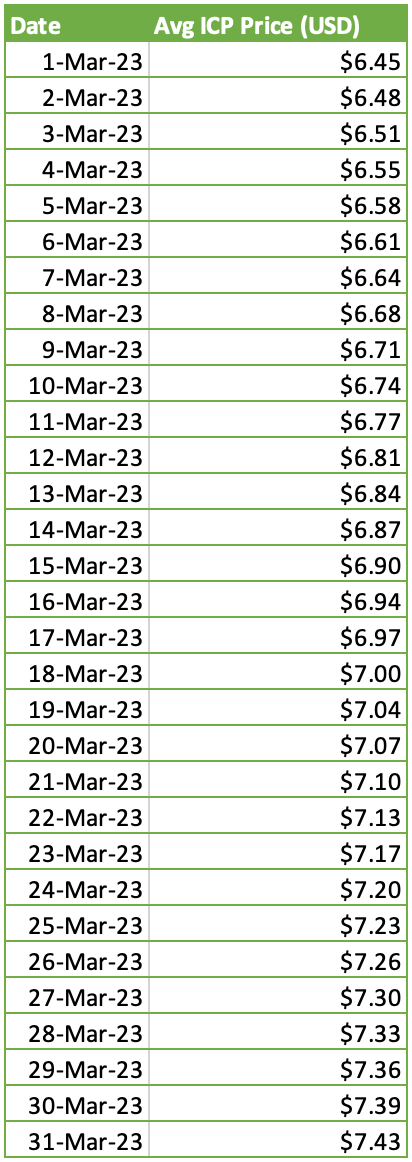

Here's what the AAA version of the Exponential Smoothing (ETS) algorithm used on the past 90 days of ICP price data has to show for us. Although it disagrees with my prediction about a holding pattern between $5.00 and $6.00 USD, it's still worth sharing in case the mathematical model is correct and my intuition is wrong — and given that the model still predicts $7.43 USD ICP by the end of March, I'd love to be wrong! Unfortunately, it's probably more likely that the math just hasn't yet caught up to reality.

Of course, the usual disclaimer for ICP price prediction always applies. Namely, any substantial price gains or losses are difficult to predict, but ICP has proven its resilience in the past and may continue to surprise us in the future.

Connect With Us:

Twitter | Telegram | Instagram | Facebook | Email

- Disclaimer: The views and opinions expressed on this website are solely those of the original author and other contributors. These views and opinions do not necessarily represent those of the CoinHustle staff and/or any/all contributors to this site.

Comments are for members only. Join the conversation by subscribing 👇.