Every participant in the Internet Computer ecosystem needs to think about matters concerning fair project valuation seriously because the SNS (Service Nervous System) will soon begin to provide the opportunity for decentralization sales

I think project valuation is an essential topic to understand, both for development teams that are trying to crowdfund their web3 project as well as investors who are trying to decide if something is a good investment. Every participant in the Internet Computer ecosystem needs to think about these matters seriously because the SNS (Service Nervous System) will soon begin to provide the opportunity for decentralization sales; plus, we already have sites like CrowdFund NFT where projects can raise capital from the community.

Here are some quick reasons why both investors and projects need to DYOR when it comes to valuations. Then we’ll get into a few ways to actually do it.

Why Investors Need to DYOR Regarding Valuations

Most projects will have more than one round of investors. The earlier you get in, the better your rewards should be. Being an early adopter means that you're an OG, someone who saw the vision before it was cool and decided to take a chance. Of course, being early comes with risks as well as potential rewards. So here are a few reasons you need to understand how valuations work:

· The valuation will change from round to round – In a perfect world, the valuation of a project will always go up, and the earliest investors will benefit the most. But this only happens if the valuation is accurate in the early rounds. Otherwise, a team may have to lower its valuation to receive future funding, and this will devalue the investment of the earlier rounds.

· Your ROI (return on investment) will depend on the valuation – Early investors are hoping to make 100 or even 1000 times what they invested. After all, in the crypto space, you are investing using cryptocurrency. If you are a true believer that ICP will one day be worth $100 or even $1,000 per coin, then you need to determine if the value of the project you are crowdfunding will increase in value even more than the token. Otherwise, you may as well just hold your coins.

· Without proper funding, a project is dead – If you invest in a project with too high of a valuation and they run out of funds to keep the project going, they may not be able to raise more money in the future. Rather than devaluing the project by asking for a lower valuation in future funding rounds, the team may just decide the project is dead and abandon it, essentially rugging early investors.

Why Crypto Projects Need to DYOR Regrading Valuations

Crypto projects need funding. You may not qualify or even want to get high-interest bank funding for a web3 project, and you may not yet be able to attract VC money. The community can be a good source of early funding, but you need to keep a few things in mind.

· You’re unlikely to get millions from the community – This means you are going to have to do future crowdfunding from VCs. If you value your project too low early on, VCs won’t want to pay a significantly higher price unless you really show advancement and adoption. So you need to put early funds to good use if you hope to keep funding your project later.

· If you value your project too high, you may get nothing – Again, the community isn’t an unlimited source of funding. Make the stakes too high, and you may get nothing. Crowdfunding can be a powerful tool but retail investors have lower liquidity and in many cases, lower tolerance for risk. Set your goals too high for a raise and you may turn the appetites of small, community investors off.

· You don’t want to pull the rug on your early investors – These are the people who believe in your project so much that they are willing to help fund you while there isn’t much to show for it yet. Don’t sell yourself short – you have to get enough money to produce results. But you also need to give early investors enough skin in the game to make those big profits when your project makes it.

Tips for Proper Valuation of a Web3 Project

The biggest mistake projects make is just checking the current value of a web2 project that is already robust and successful and saying, “We’re making something similar on web3, so this amount is fair.” I promise you that those web2 companies did not get their early funding by writing “trust us” on a napkin and sliding it across a greasy diner table to a VC.

That said, here are a few valuation tips that can be used by crypto projects to set a valuation, as well as by investors to determine if the project sets a healthy valuation. Keep in mind that this is not financial advice, as I am not a financial advisor. This is a collection of tips from professional sources on how to value a company:

· Market Cap is the simplest valuation method – Of course, this is usually an “after the fact” figure that comes from a publicly traded company’s sale price. However, you can get the market cap of a web3 company by determining the total value of all tokens. For example, at the time of writing, the market cap of SNS-1 is approximately $2.04M (10,000 tokens x $204). Compare this to when SNS-1 was launched, the tokens were valued at about $4/each. So the market cap was technically a mere $40,000 at launch.

Other projects may set their own market cap for early investors before the SNS kicks off and opens the door for new, potential investors. For example, Catalyze has valued their company at $30M, and so they are distributing part of their 500M tokens to investors at a rate of (approximately) 6 cents per token. After the launch, price discovery will determine if this valuation is accurate.

· Discount Cash Flow is ideal for early projections – Basically, you project the company’s cash flow for the next five years and then discount it by a set amount to offset things like inflation and to give your early investors a bit of a discount. Investors need to see these estimates in order to make an informed decision. You can learn more about how to calculate Discount Cash Flow on Investopedia.

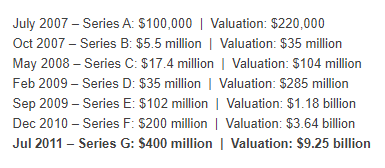

That said, there is nothing wrong with looking at how similar companies have valued themselves. You just need to know where you are at in the funding rounds. For example, in the chart above, you can see seven funding rounds done by Twitter over the course of four years. Some things to notice and imitate:

· The valuation increased each time, creating more value for earlier investors.

· The amount of funding increased each time, providing the company with the funds it needed to continue building.

· The company clearly put the funds to good use, which is how they were able to continually attract the next round of investors.

· Twitter’s current market cap is $41.09B, showing that even the investors in the last round of funding in July 2011 have more than a 4x ROI (assuming they still hold their shares).

Learn More About Project Valuations and how to DYOR

I’ll conclude by sharing a few sites where you can learn more about company valuations so you can continue to DYOR.

· Harvard Business School provides six methods for valuing a company – Keep in mind that many of these apply more to publicly traded companies, but the principles still apply.

· The Hartford offers five valuation strategies – While this article is geared toward selling a business, the same principles can apply to determining the valuation for raising funds.

· Sites like ForgeGlobaland PitchBook can show you the funding rounds of other companies in the past so you can compare past valuations of similar brands. Just remember that the success of one company does not ensure another company from the same industry will be equally successful.

I hope this article helps both crypto projects and investors understand how to DYOR when it comes to seed rounds and crowdfunding. This is particularly important for the Internet Computer as more projects will begin to use the SNS for decentralization sales.

Connect With Us:

Twitter | Telegram | Instagram | Facebook | Email

- Disclaimer: The views and opinions expressed on this website are solely those of the original author and other contributors. These views and opinions do not necessarily represent those of the CoinHustle staff and/or any/all contributors to this site.

Comments are for members only. Join the conversation by subscribing 👇.