Internet Computer (ICP) tokens began trading on the Coinbase Pro exchange on May 10. In two days, the value of the digital currency rose seven times and collapsed five times, but it still ranked among the world's top crypto in terms of capitalization. Dfinity says it wants to compete with the most prominent IT corporations and create a giant "internet-computer" project, of which tokens are a part.

The Internet Computer Protocol has two native tokens

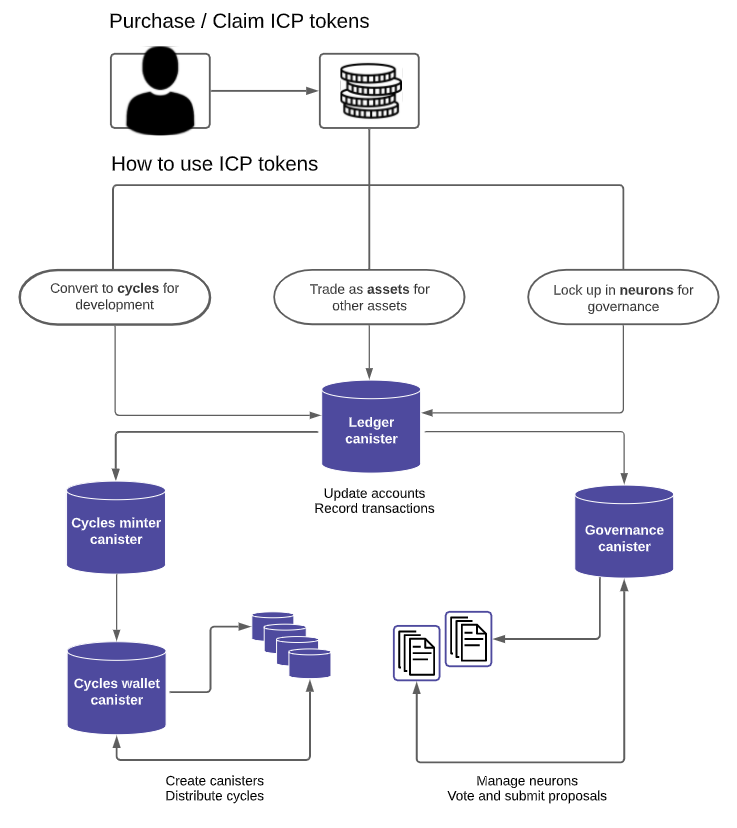

There are two native tokens involved:

• ICP is a proprietary control token for managing the network;

• Cycles is a stable coin used to support computation.

ICP tokens have three main functions. Two of them are inflationary, and one is deflationary.

1. Network Management (Inflationary)

ICP tokens are locked inside the NNS, the algorithmic protocol control system that runs the network. These tokens are used for creating neurons that play their role in voting on proposals.

Each month, NNS checks the proportion of votes in which a neuron participates to pay out a proportional share of the reward. To maximize participation, and therefore reward, users can delegate votes to other trusted neurons.

Conversion of neurons back to ICP is not instantaneous and requires a "dissolution" period. Users can set the duration of the dissolution. The longer the period, the more voting rights the neurons have, and the greater the reward for voting. This is similar to Curve Finance, where longer, up to 4 years, blockchains increase voting rights to align stakeholders with the network's long-term success.

The dissolution period can only be increased. To start the unblocking period, users need to put a neuron into dissolution mode. Currently, the dissolution period must be between 6 months and eight years to vote. In addition, neurons can increase their voting power and reward by aging, measured by the time elapsed since they were last put into dissolution mode.

Thus, the 370 investors of the round have an advantage. They can increase their dissolution time to take advantage of the high prior age or dissolve their neurons to get ICP tokens.

2. Participation Reward (Inflation)

The network creates new ICP tokens to reward key players. In addition to voting rewards for those who participate in management, "computational rewards" are provided to those who manage the nodes on which the network is hosted. NNS generates new ICP tokens to reward the nodes managed by data centers and neurons.

Essentially nodes rewarded for "not statistically deviating". For example, since node hardware is standardized, a node should produce approx the same number of blocks as other nodes in its subnet blockchain. Fixed rewards for correct behavior. Slashing if bad deviator

— Dominic Williams ∞ (@dominic_w) July 13, 2021

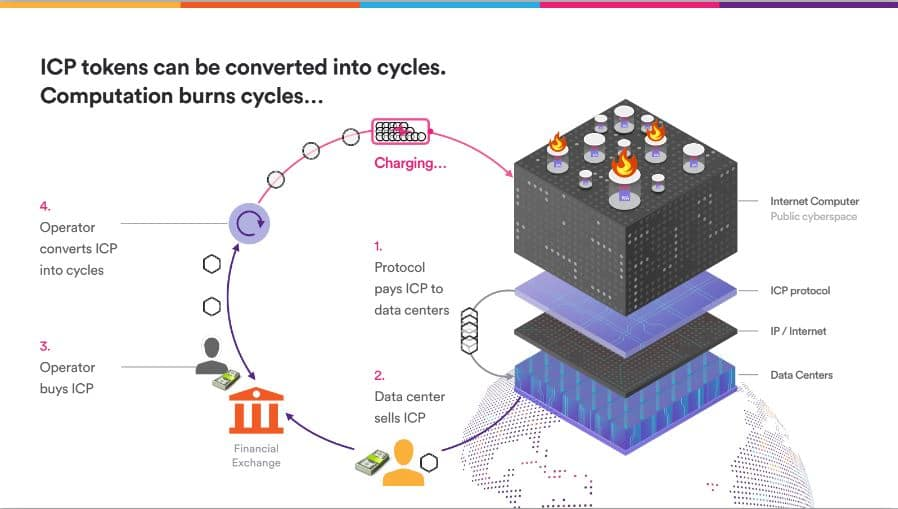

3. Creating Cycles for Computation (Deflation)

ICP is converted into Cycles as fuel for computation using containers. The Cycles/ICP exchange rate depends on external markets and follows the rule that burning 1 SDR (an asset created by the IMF containing US dollars, euros, yen, and pounds sterling) will always create 1 trillion Cycles.

Terra also offers an SDR-based stack called TerraSDR, but the ICP burning mechanism is a new stabilization feature.

Unlike Ethereum, users do not have to pay commissions. Developers precharge containers with Cycles for a certain number of computing units. This practice is similar to how the traditional Internet works, where developers pay AWS for cloud services.

Therefore, users do not need to own ICP tokens to interact with hosted services or even know they are running on a blockchain.

Essentially, data centers and neuron owners exchange ICP tokens with container owners and managers. The container owners and managers convert ICPs into Cycles, and those Cycles fuel the containers to run. The process of burning ICP tokens to convert to Cycles to run computation is deflationary.

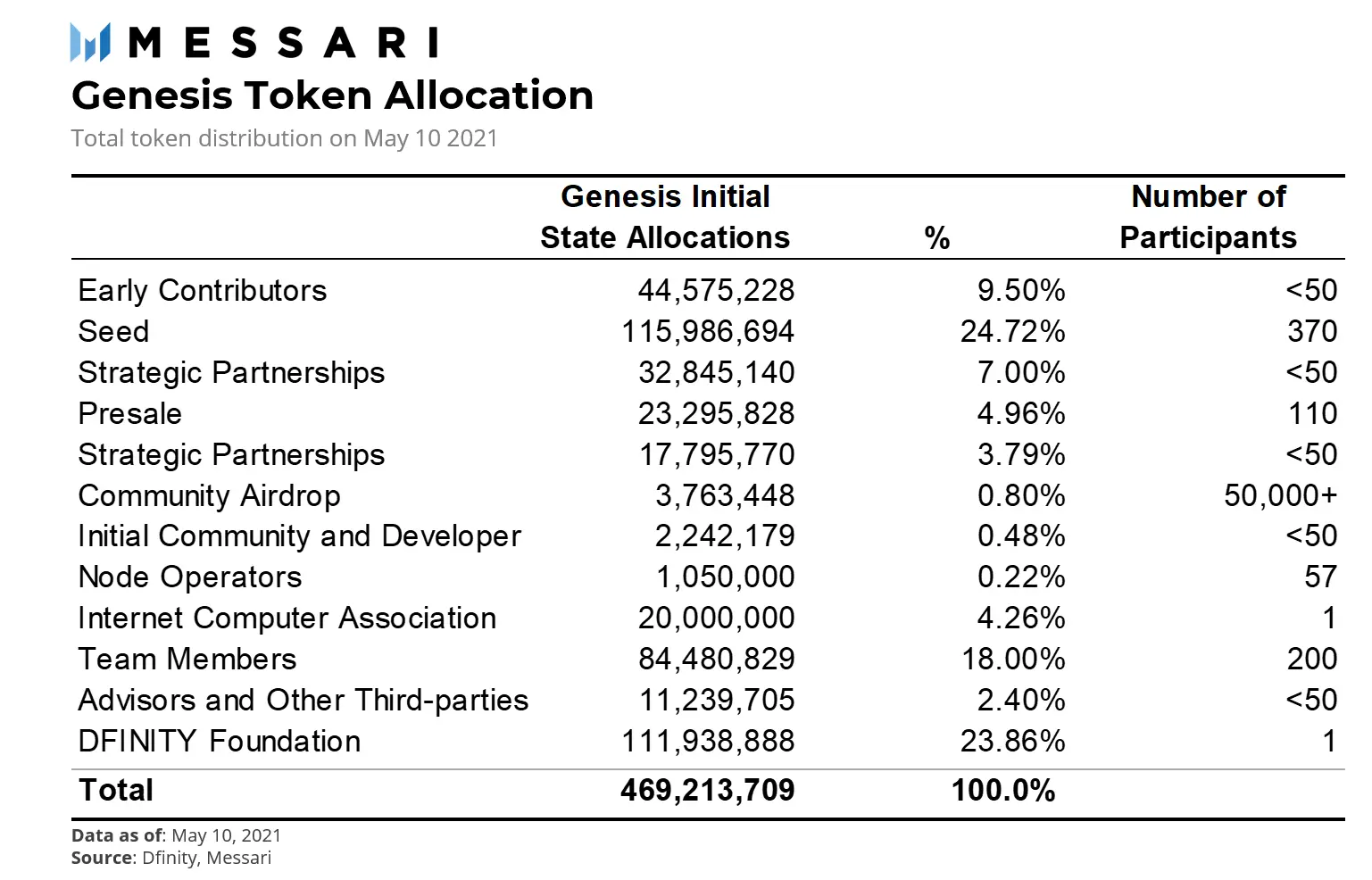

ICP token allocation

When the Dfinity Foundation was first formed, 9.5% of the tokens were distributed to early participants. On May 10, through the Genesis Unlock initiative, NNS issued ICP tokens. Thus, thousands of token holders will create "voting neurons" that control NNS and, by extension, the entire network.

The timeline for unlocking tokens for strategic investors and the private round is public knowledge. Still, the number of available tokens issued by the Internet Computing Association, team members, consultants, early adopters, and the Foundation is unknown.

Due to the governance and rewards mechanism, most of the tokens will likely be locked.

The amount of locked tokens depends on two factors:

• Governance

• Rewards

The ecosystem itself will find a natural balance of how many rewards are required to reach the optimal number of participants.

Dfinity wants 90% of the token supply locked in neurons, and the rewards should be sufficient to achieve this goal. With a fixed amount of dividends, fewer participants will create more rewards per participant, which should help attract more participants (and thus lock ICP tokens).

A longer duration of staking gives higher voting power and rewards

Since the risks and uncertainties associated with the network are higher at the outset, the rewards should be much higher. However, as the network stabilizes, the rewards may decrease over time, reflecting the lower risks.

Based on estimates of required returns as a percentage of current supply, Dfinity will start with an annual distribution of 10% of supply. After eight years, that amount will drop to 5% to reflect the lower risk and required reward.

Curve Finance has a similar mechanism with a maximum lock-in period of 4 years. About 49.5% of all circulating CRVs are locked in for an average of 3.7 years. If ICP follows the same path, we should expect half of the circulating tokens to be locked for voting for nearly eight years.

Inflation and deflation depend on many factors.

ICP has an uncertain timetable for issuing tokens due to deflationary and inflationary pressures. Deflationary pressure depends on computation on a platform that relies on activity in the ecosystem. Inflationary pressure is based on rewards for nodes and voting. In addition, tokens are locked in neurons in order to participate in the network. Such tokens are illiquid and cannot be freely transferred to others. Consequently, it is complicated to estimate the number of liquid tokens.

More resources from DFINITY

- Disclaimer: The views and opinions expressed on this website are solely those of the original author and other contributors. These views and opinions do not necessarily represent those of the Dfinity Community staff and/or any/all contributors to this site.

Comments are for members only. Join the conversation by subscribing 👇.